BSE Code

|

524230

|

NSE Code

|

RCF

|

Bloomberg

|

RCF IN

|

Market Price as of 16th July

|

50.00

|

Eq. Capital (Rs crs)

|

551.7

|

Face Value (Rs)

|

10.00

|

Equity Sh. Outs (Cr)

|

55.17

|

Market Cap (Rs crs)

|

2739.13

|

52 Week High

|

61.40

|

52 Week Low

|

35.25

|

Recommendation

RCF is a buy at CMP (current market price) with an estimated upside of 25%. Target Price – Rs. 64.

Strong tailwinds such as rising production and consumption of fertilizer in India, expansion plans at Thal, implementation of direct benefit transfer and favorable weather conditions support this recommendation.

Company Overview

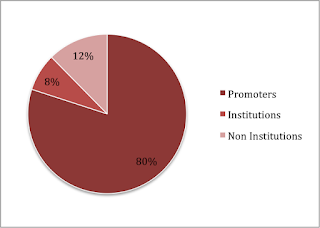

Rashtriya Chemicals & Fertilizers Ltd (TCKR: RCF) is a Public Sector Undertaking (PSU) in India under the Ministry of Chemicals and Fertilizers of the Government of India, based in Mumbai. RCF is one of the leading producers of fertilizers in India. It was established on 6th March, 1978 on the reorganization of Fertilizer Corporation of India Ltd. into five new companies. The Government of India holds 80% stake in the company.

Rashtriya Chemicals and Fertilizers Ltd. has been accorded coveted “Miniratna” status (a status awarded to well performing public sector units) in 1997.

The company manufactures Urea, Complex Fertilizers, Bio-fertilizers, Micro-nutrients, 100 per cent water soluble fertilizers, soil conditioners and a wide range of Industrial Chemicals from its two manufacturing plants located at Trombay in Mumbai and at Thal in Raigad district. The company’s Industrial chemicals find elaborate applications in many industries like dyes, solvents, leather, pharmaceuticals and a host of other industries.

Industry Overview

Fertilizers are a key component in the growth of India’s agriculture sector, which accounts for about a seventh of the country’s GPD. Therefore it is only in keeping with the importance of the sector that India is the world’s second-largest consumer of fertilizers, (China is the first), and the world’s third-largest producer.

There are two primary fertilizer categories: Urea and non-urea. India’s produces about 80 percent of its Urea fertilizer needs. And the fertilizer industry has the capacity to indigenously meet 50 percent of the country’s phosphatic fertilizers. But India still depends heavily on imports for the raw ingredients for its phosphatic and potassium fertilizers.

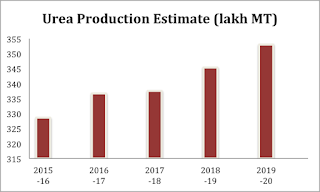

India produced a record 245 lakh tonnes of urea in 2015-16, the highest ever quantity of the commonly used fertilizer. This was aided in part by the new urea policy implemented since 2015. The Policy has multiple objectives of maximizing indigenous urea production and promoting energy efficiency in urea units. Production of urea is 20 lakh tonnes more than the year before, and together with timely imports this has ensured adequate availability of the fertilizer across the country.

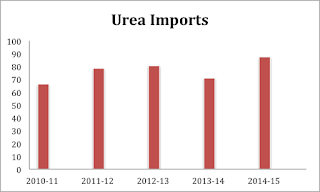

By all these measures, import dependency of India for urea is likely to reduce drastically under the “Make in India” policy. Presently, India is importing about 80 lakh metric tonnes of urea out of total demand of 310 lakh metric tonnes.

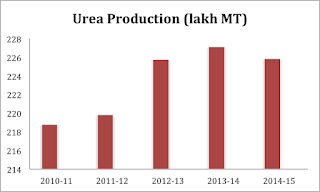

While the country currently consumes~300 lakh tonnes of urea, production was around 220 lakh tonnes reflecting space for growth and market penetration.

Apart from urea production, there is also a lot of growth potential for NP/NPKs type of fertilizer. (RCF sells this under the brand name "suphala" which it's second most popular product)

Relevant Company Information

Products

The company’s two major product segments are fertilizers and industrial chemicals. The company holds significant market share and strong presence in the fertilizer segment. The industrial chemical segment, with higher margins, is growing rapidly (PBIT margins of industrial products are have been more than 19% during FY12-FY14 compared to 6.5% in fertilizers)

The company has five types of fertilizers that cater to diverse needs of farmers.

RCF took the advantage of manufacturing industrial products since its fertilizer manufacturing process already incorporated Ammonia, Nitric Acid and Sulphuric Acid plants. R.C.F manufactures chemicals such as Methanol, Sodium Nitrate, Sodium Nitrite, Ammonium bicarbonate, Methylamines, Dimethyl Formamide, Dimethylacetamide.

It should be noted tht RCF is the only manufacture of Dimethyl Formamide (DMF) in India. DMF is a solvent that has major applications in the production of plastics and acrylic fibers.

The industrial products segment contributes about 13% to revenues while 88% of revenue comes from the fertilizer segment.

Shareholding Pattern

The government of India holds 80% of shares. One potential risk is the government selling these shares under it’s divestment policy.

Management

Shri Manoj Mishra: Chairman & Managing Director (Additional Charge)

• Shri Mishra has taken over additional charge of Chairman and Managing Director (CMD), of the Company w.e.f. 15th June, 2016.

• Shri Mishra is a member of the Institute of Cost Accountants of India. Shri Mishra has professional experience of more than 30 years in various Public Sector Undertakings and Cooperative sector.

• Shri Mishra is also Chairman and Managing Director of National Fertilizers Limited.

• Shri Mishra is the Chairman of Ramagundam Fertilizers & Chemicals Ltd. and Director of The Fertilizer Association of India.

• He was recently conferred the "Icon of the Year" award by the Institute of Cost Accountants of India.

Shri Dharam Pal: Government Nominee Director

• Shri Pal is an IAS and was nominated by President of India as Director by the Board w.e.f. 28th January, 2016.

• Shri Pal presently Joint Secretary, Department of Fertilizers, Ministry of Chemicals and Fertilizers, New Delhi.

• He has varied and rich experience in Government, in different positions.

The company has sound and experienced management personnel.

Market Presence

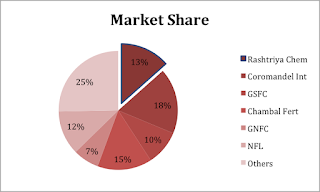

RCF is the third largest player in the domestic urea industry in terms of production capacity. The company had a share of around 11 per cent in the domestic urea market, which is sold under the popular brand name “Ujwala”. Complex Fertilizers, sold under the brand name “Suphala”, enjoy about 5.4% market share and has a strong position in its primary markets of Maharashtra, Karnataka, Andhra Pradesh & Telangana.

Trends

Trend 1: Promising Expansion Plans

One of the key factors driving the investment rationale is the projects that the company has in its pipeline:

Thal 3

The company is developing a new ammonia-urea Plant at Thal. In-view of acute shortage of Fertilizers in India and dependency on imported Urea, RCF has proposed to set up additional stream of Ammonia-Urea at its Thal complex. This also comes in the backdrop of the government’s strategy to revive the rural economy by focusing on irrigation and urea availability.

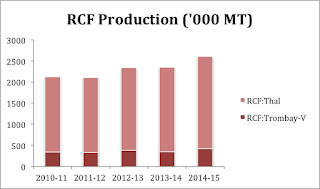

RCF proposed to set up 3850 MTPD Urea and 2200 MTPD Ammonia Plant at its existing Fertilizer complex in Thal. The estimated project cost is around 5,400 Crore. Approval from concerned government authorities is underway. PIB clearance has been obtained while Cabinet CCEA (Committee on Economic Affairs) clearance is awaited. This expansion plan could on completion increase its topline by 35-40% by FY20.

With the recent development, the production is Thal, the larger plant, is expected to rise even further.

Iran Project

Rashtriya Chemicals & Fertilizers Ltd. (RCF) and Gujarat State Fertilizers & Chemicals Ltd. (GSFC), are jointly working to establish the viability of setting up a fertilizer plant in Iran. The proposed plant capacities are Ammonia (2,500 TPD) & Urea (3,850 TPD).

SBI Caps has been appointed to assist selection of Iranian JV Partner and in formation of the JV. The estimated project cost is around 6058 Cr. (US $ 903.30 Million).

Trend 2: Direct Benefit Transfer to increase working capital efficiency

Currently fertilizer subsidy is paid to farmers through fertilizer companies. With the implementation of DBT, fertilizer companies would realize full price of their products at the point of sale and the subsidy part would be directly paid to the farmers by the government. This would do away with the delays companies faced due to late release by the government and reduce their working capital needs.

Trend 3: Favorable weather conditions to boost revenue

RCF suffered from poor results in FY16 due to 2 back to back deficient monsoon in areas it was prevalent in (Maharashtra, Karnataka, AP and Telangana). This led to a fall in margins/profits in FY16. In FY17 however, going by the forecast from IMD and Skymet, monsoon in India is likely to be 106-109% of normal and this could lead to a better demand for fertilizers in the current and subsequent season.

Financials

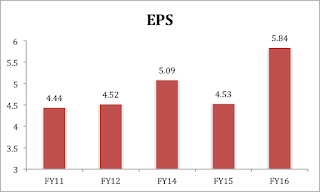

RCF has solid financials with revenue and profits following a general upward trend. Profit increased at 7% CAGR (’11-’16) and revenue increased at 9% CAGR (’11-’16).

The company has also been steadily increasing dividend. During FY16 the company paid a dividend of 1.80 with EPS of 5.84 resulting in a healthy dividend payout ratio of 30.8%. The company’s dividend payments have been growing at a CAGR of 13% (’11-’16).

The company also has solid and increasing margins. Profit margin increased to 4.04% compared to 3.67% last year. EBITDA margin increased to 11.12% compared to 9.23% last year.

The company also has a healthy balance sheet. The current ratio for FY16 is 1.62 . Debt to equity ratio is 0.70, which is higher than the previous year – appropriately so because the company has taken on debt to fund it’s expansion plans. Interest coverage ratio is 5.36 compared to 3.80 last year indicating the debt increase shouldn’t be an issue.

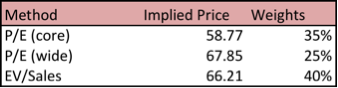

Trading at a discount: Valuation

Note: To derive the valuation, I used the median. For wide comparable companies, I included additional financials of the following companies: Fertilizers and Chemicals Travancore, Deepak fertilizers, Zauri Agro Chem and Nagarjuna Fertilizers.

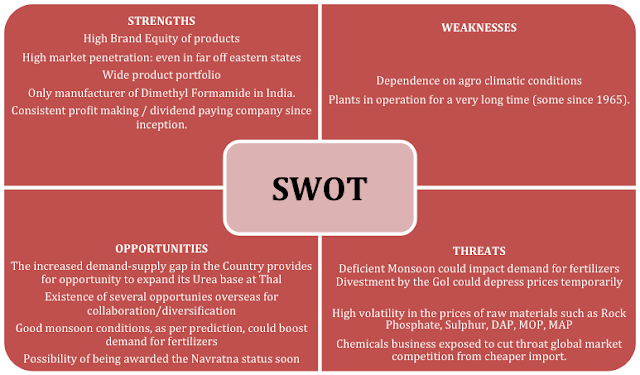

Summary: SWOT Analysis

Are you searching for Best Industrial Chemical Corporation ? Eastarchem is the Best Industrial Chemical Corporation. We offer a broad variety of services to our partners in the industrial chemicals solutions. We are high-class suppliers of Industrial chemical distributor, industrial chemical solutions in usa and all counties around.

ReplyDeleteNice post. Thanks for sharing! I want people to know just how good this information is in your article. It’s interesting content and great work.

ReplyDeleteamino acid fertilizer manufacturers in maharashtra

It contains the data I was looking for and you have in like way enlightened it well and your interesting offer. I'm happy to discover your post. Continue sharing this kind of stuff.

ReplyDeletemg edta fertilizer manufacturers in maharashtra