Back in February, when I read about negative interest rates in Japan it seemed Bizarre to me. I did not understand what it meant and my laymen understanding of interest rates made me assume that depositors would be the one’s who would have to pay money to store their wealth in banks.

Also, last time I checked zero was supposed to be the lower bound on interest rates.

So, what really are negative interest rates and how do they impact the economy.

First things first: NO, depositors (like you and me, normal citizens of the world) do not pay money to deposit their money.

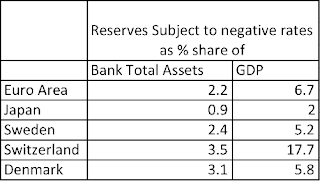

We’re talking about other interest rates here. In every country, commercial banks keep some money with the central bank. Some of those funds are required to be deposited, as a cushion for financial crisis like situations and the other are excess funds that the central bank would like to keep in store (for security, or just so that they can earn some interest on it – it’s usually not a lot, but its 100% risk free). These interest rates, that the central bank pays commercial banks for depositing money are what we’re talking about.

So let’s look into this:

On January 29, Bank of Japan announced of its negative interest rate policy under Governor Haruhiko Kuroda. The policy was effective 16th February, 2016 onwards.

The bank divided the current account balances that financial institutions keep at the BOJ into three tiers:

• Existing balances continue to have a rate of 0.1 percent. This is called the Basic Balance.

• A rate of zero percent is applied to the reserves that institutions are required to keep at the BOJ, and also the reserves related to the bank’s various lending support programs. This is called the Macro Add-on Balance.

• Finally, the nagative rate ones in. A rate of minus 0.1 percent applies to any reserves not included in the first two tiers. This is called the Policy-Rate Balance. The additional or excess money that banks chose to store.

Now, this negative interest rate policy isn’t very new or innovative. This has been happening for a long time now for a number of purposes. Major causes for the implementation of this policy are to stimulate economic growth, combat deflationary pressures, stimulate businesses and most importantly devaluing the currency.

A quick history class:

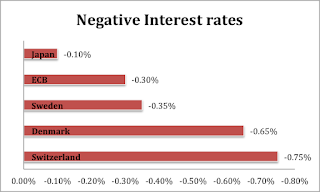

Back in the day (early 1970’s), switzerland was having a serious currency appreciation problem. A lot of investors were buying the swiss franc due to the economic turmoil in Russia. The swiss have always been stable people, hence making their currency a safe haven. Now why was that a bad thing? A strong currency is bad for exports because it makes the country’s goods and services relatively more expensive and nobody likes that.

In 2009-10 Denmark, and in 2011 Sweden implemented negative interest rates to stem hot money flows into their economy. Everyone remember the 2008 financial crisis right?

And finally, the europeans entered this negative inetesrt rate territory in 2014, when ECB (European Central Bank) implemented negative rates to prevent the eurozone from falling into a deflationary spiral.

Well, BOJ had no other option. They tried another policy first which came in the form of asset repurchasing. It came in the form of larger and larger asset purchases that now total ¥80 trillion yen. They still repurchase assets but since it wasn’t working so well they decided take it a step further.

Japan really really needs this to work because the country is looking at some serious deflation. I come from an inflationary country, India, so I never understood why deflation was a bad thing. But well, think about this, what is economic growth? Low prices are indicative of lack of demand in the economy. So consumers are willing to pay less for goods and services. Consequently, profit margins of companies are declining which leads them to cut costs. Therefore, they try to cut wages. As wages go down, demand goes further down and so do prices and profits. Suppliers might not be able to produce at such low prices or they might not wish to because they aren’t making much money. Slowing production is basically slowing economic growth and nobody likes that. Therefore, a healthy level of inflation (usually 2%) is required for the economy to function well.

It should also be noted that deflation is more difficult to deal with than inflation because during inflation, all the central bank has to do is take money from the people. When a country is in deflation, the central banks and governments have to pump money into the economy and to do that they have to take debt. (Taking money is always easier than giving it) Simple rule: too much debt = bad. It leads to a debt trap because sometimes the country will have to keep borrowing more to finance that debt (i.e. pay interest).

Another problem was strengthening of the currency. A lot of people flood to the yen as a safe haven in times of economic uncertainty. This makes it difficult to export and well, Japan needs people to keep buying those Hondas and toyotas.

So now we know that Japan implemented this policy with noble goals in mind but it is time to see if these goals yielded any results.

Impact on Economic Variables:

Impact on inflation

Like discussed before, the purpose of the negative interest rate policy was to stimulate the economy and reach that 2% inflation target. Has it worked? Has Japan even gotten close?

Yes, I said it right, Japan wants to achieve the 2% inflation target (you can chuckle, it’s fine). Has it gotten any closer to it’s goal since it’s negative interest rate policy? Nope.

Impact on Currency

Lower interest rates normally lead a country’s currency to depreciate, helping its exporters—a key aim of “Abenomics,” the package of stimulus measures brought in by Prime Minister Shinzo Abe to revive the world’s third largest economy and one of the globe’s largest exporter.

Well, it hasn’t been working so far. Infact the yen has been strengthening against the dollar.

Heard of the Brexit? (Yes, it’s everywhere)

That’s one of the reasons the situation isn’t improving. People are looking for safer investments to park their assets and the Yen seems to be one of those assets. Another reason for this increase is that the US Fed isn’t raising rates. (USD is another safe haven currency).

Moving forward: The trend is expected to continue. HSBC boosted its year-end forecast to ¥95 per dollar from ¥115, while Standard Chartered PLC followed with a similar increase to ¥100 from ¥120. Citigroup, the world’s biggest currency trader, raised its estimate to ¥104 from ¥111, while suggesting the yen could trade within a 95-100 range in coming months. Mizuho now sees a rally to ¥97, instead of a slide to ¥112.

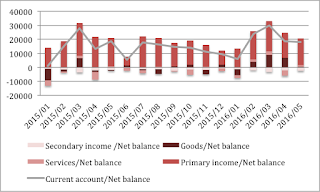

Impact on Foreign Trade

Due to the recent rally of the yen, foreign trade has been negatively impacted. The current account surplus in Japan contracted 2.4% to ¥1.809T ($18B) in May. A stronger yuan contributed to the first narrowing of the current account in almost two years.

Impact on Banks

Well, let’s say negative interest rates are not one of commercial bank’s favorite things. The reason being that banks still pay positive rates on deposits, but since they can’t keep the money with central banks, they have to make lending cheaper and therefore, the interest that they get on loans decreases. Therefore, their margins are sqeezed and they don’t make as much profit as they used to.

Mitsubishi UFJ Financial Group Inc., the largest Japanese banks sees full-year profit falling 11 percent as negative interest rates squeeze loan profitability and bad-loan costs increase. Mitsubishi UFJ Financial Group Inc. CEO, Nobuyuki Hirano has been among the biggest critics of the Bank of Japan’s negative-rate policy, saying last month that it has caused anxiety among households and companies and will weaken lenders by narrowing net interest margins. Japanese bank stocks havent been performing too well this quarter. (stock market index for the Tokyo Stock Exchange).

Impact on Money Markets

They messed up: the trade-confirmation system used by money-market brokers wasn’t fully updated for negative interest rates until over a month after the BOJ rate cut. Money market is usually a place for banks and financial institutions to park excess liquid reserves for short spans of time – by lending it to other banks but if the banks have to pay a positive rate on this, why would they accept it. April onwards, the system got on track and the banks are now charging a fee of 0.1% fee on these reserves.

Drying up of money markets is a major problem because if there is a black swan event like the Lehman crisis, there won’t be the adequate financial infrastructure for banks to raise capital.

On ths, Mr. Koruda, the central bank governor said, as market players get used to negative rates, money-market trading should increase.

Impact on the Stock Market

So here is the sexy part: the stock market. Well, it doesn’t look so sexy anymore with people selling more than buying. Ideally, one wouldn’t expect this happen since more liquidity would mean more buys, right? Wrong.

Reasons:

- Loss of faith in policy makers

- Inability to meet inflation targets

- No further changes in monetary policy after January.

Impact on Bonds

Bonds: Risk free investments. Not so sexy. But people have been moving their money into bonds despite bonds yields entering the negative territory. Net foreign buying of medium-term Japanese government bonds was double the 12-month average in February.

Yes, it’s crazy. Japans 10 year and 20 year bonds are in negative territory and the yield on it’s 30 year bonds is just 0.015%. People are buying bonds even though they will get less money back at maturity than they payed to purchase the bond. Bonds, like every other security and well everything in life, work on the principles of demand and supply. Economic uncertainty is spiking demand for safe assets and the supply of these assets is relatively inelastic. Hence, prices go up and yeilds go down because at the end of maturity, you still only get the face value back.

Another reason for this spike in price leading to negative yield is the central bank. At this point, everything the bank does is wrong (everyone been there right?). Too much repurchase of bonds (to increase liquidity) is causing this tremendoes decline in yields. The bank must therefore put a floor to this yield and move to other assets and securities.

I mean the negative yields are obviously good for the government because they get paid to take debt but one risk is that easing interest-payment pressures will make it easier for Japan—which has gone through two decades of stagnation—to pile up yet more debt in an attempt to goose growth. If governments are being paid to issue debt, that reduces incentives to undertake necessary fiscal reform or push through tough economic overhauls.

What are investors thinking?!

If deflation continues, then the value of one unit of currency increases. Therefore, if the rate of deflation is higher than negative yield rate, then investors are still making money.

Explaination

Nominal Rates - Inflation = Real rates

Assuming that the negative interest on 10 year bonds is 0.1 and the rate of deflation is 0.3.

Real rate = -0.1 – (-0.3)

= 0.2

Ta-da!

Also, for foreign investors, a strong yen into more domestic currency. So, if the yen strenghens more than yields fall (which seems to be happening): foreign investors make money.

Another rationale could be that investors expect BOJ to continue monetary easing (like dropping the interest even further and asset repurchasing) then the price of the bonds will increase and the investors could sell them then and make money.

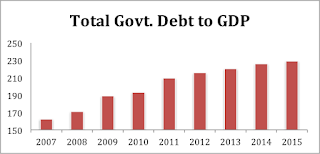

Impact on Debt

See for youself

A lot of this debt is domestic debt raised through bonds so it shouldn’t be too bad, since they need to pay it back in their own currency. Due to strengthening of the currency, interest payments are also going to be cheaper. However, we’re missing the point. The whole purpose of these policies is to increase liquidity so people can go out there and buy stuff. But if debt is increasing, then people are parking their money into these debt instruments and by the end of it getting less money back. Don’t feel like shopping much now, do we?

Impact on Businesses:

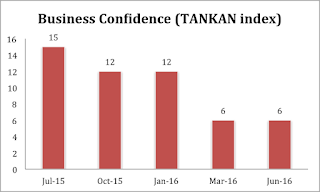

Every quarter, BOJ takes a survey of manufacturers in Japan and comes up with the Takan index of Business sentiment and the numbers don’t look so good.

Recent data shows that machinery orders, the best proxy for capex, dropped 8.2 per cent from the previous year which isnt a good sign because less capital expenditure is a sign of pessimism.

Now the most important question:

What Next?

There is no stopping the bank. The Bank of Japan is likely to move rates from negative 0.1 per cent to minus 0.3 per cent come the end of July, increase its holdings of ETFs from ¥3.3tn to ¥6.3tn as well as its purchases of Japanese Reits from ¥90bn to ¥200bn, economists at JPMorgan in Tokyo predict.

Sigh.

Interest rate manipulation and huge fiscal deficits haven't helped out Japan for nearly 30 years. The effectiveness of the Keynesian remedies employed need to be called into question. These solutions seem to be short term and temporary. Eventually, the government needs to address things like ageing populations; worker productivity etc. to ensure that economic growth improves over the long term.

------------------

“interest”ing?

No comments:

Post a Comment