Summary:

· Strong tailwinds in the overall macroeconomy such as low oil prices, availability of credit, strong employment data and favourable exchange rate.

· Positive trends in the industry such as increasing car parc, increasing age of vehicles and rising vehicle miles driven leading to top line growth

· Company expected to launch new product line by the end of current quarter, allowing it to diversify and further increase revenue

· Stock trading cheaply. The Recent sell off (RSI reaching below 30) brought the stock close to its 52-week low.

Company Overview:

Motorcar parts of America (NASDAQ: MPAA) is a manufacturer, remanufacturer, and distributor of aftermarket automotive parts for import and domestic cars, light trucks, heavy duty, agricultural and industrial applications.

The company sells its products predominantly in North America to the largest auto parts retail and traditional warehouse chains (Such as AutoZone, Genuine Parts, O’Reilly etc) and to major automobile manufacturers for both their aftermarket programs and their warranty replacement programs.

Products:

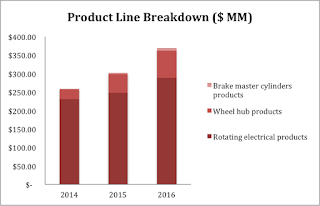

The company operates in three major product segments:

· Rotating electrical products such as alternators and starters

· Wheel hub assemblies and bearings

· Brake master cylinders

There is continued strength across all product lines.

The company is focused on gaining market share in existing product lines and is actively working on introducing new products as well. The company launched the brake master cylinder line in late July 2014; sales are rapidly picking up since then. According to the recent earnings call, the company plans to launch a new product line by the end of the current fiscal quarter ending September 2016. These new product line launches help the company address market demand as the management believes “the increasing complexity of cars and light trucks and the number of different makes and models of these vehicles have resulted in a significant increase in the number of different automotive parts required to service vehicles.”

Source: Annual Report

|

|

2014

|

2015

|

2016

|

15-16 YOY growth

|

|

Rotating electrical products

|

$230.22M

|

$247.40M

|

$287.80M

|

16%

|

|

Wheel hub products

|

$28.45M

|

$51.29M

|

$73.79M

|

44%

|

|

Brake master cylinders products

|

-

|

$3.02M

|

$7.38M

|

145%

|

Management:

CEO: Selwyn Joffe, CPA

· Chairman of the board, President, CEO

· CEO since Feb 2003, Chairman since Nov 1999, Director since 1994

· Prior to February 2003, Mr. Joffe was Chairman and Chief Executive Officer of Protea Group, an international business management firm

· Earned a bachelor of Business and Law from Emory University.

CFO: David Ashley Lee, CPA

· CFO since Feb 2008

· Prior to this, served as Vice President of Finance and Strategic Planning since January 2006

· Joined the company February 2005 as a Director of Finance and Strategic Planning.

· Earned his degree in economics from the UCSD, and Masters in Business Administration degree from UCLA.

Takeaway: Management has solid educational credentials and a lot of experience with the company.

Institutional: 85% of the company’s shares are held by institutional investors such as Fine Capital Partners (7%), Blackrock Fund Advisors (6%) and Wells Fargo (5%).

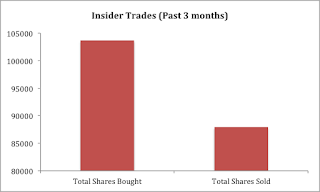

Insiders: Insiders hold 7.3% shares. Over the past three months, insider buy trades have been exceeding sell trades.

Source: MergentOnline

Takeaway: High institutional ownership and increasing insider holding are all positive indications.

Industry Trends:

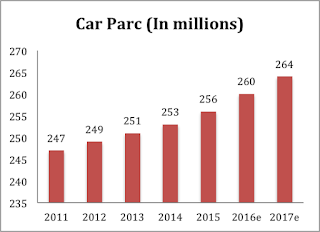

Source: IHS, CHLM estimates

Unlike other trends, this trend is not contingent on fuel prices and thus the company is sure of the impact of this trend on top line growth.

2. . Increasing Car Parc

Source: IHS, CHLM estimates

3. Low Oil Prices

Low oil prices along with lower unemployment lead to an increasing in average miles travelled. As more miles are travelled, there is increased wear and tear, which leads to increasing replacement rates of aftermarket automotive parts.

Source: FRED

Low gasoline prices also compel consumers to use a repair shop rather than service their vehicles on their own. This results in a shift from Do-It-Yourself segment to Do-It-For-Me segment, which has higher margins. Additionally, lower gas prices increase disposable income, freeing up more than $40 billion for deferred vehicle maintenance. These factors put the auto parts industry in an advantageous position.

Due to a drastic decline in global crude oil prices, industry revenue is expected to jump 3.2% in 2016-17.

Company Trends

1. Strong Organic Growth

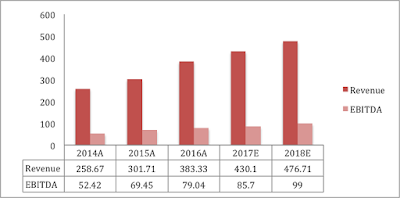

Over the past three years, sales have grown at 22% CAGR ('14-'16) and EBITDA has grown at 23% CAGR ('14-'16).

As the company increases market share for existing products and launches new product lines, revenue is expected to continue escalating.

Source: MergentOnline

Revenue and EBITDA estimates are from consensus estimates and in line with management’s expectations. The estimates are conservative because management strives to achieve revenue growth of at least 20% on an annualized basis.

Top line growth is expected to come from new product launches and increased market penetration. In the recent earnings call, management remarked “To put our overall potential in perspective, industry sources estimate the market size of the USA and Canada for our current products to be approximately $3.8 billion at the consumer level. The remaining potential in these markets for hard parts is estimated to be $106 billion plus, which should provide us with a lot of opportunity to introduce new parts and grow our business organically with the growth of existing and new product lines and through appropriate acquisitions.”

The company has also been stepping up in infrastructure to support this growth, according to management commentary. The company launched a whole new marketing team and built a completely new innovation center. The company has also staffed up a new acquisitions team. Along with that, the company has enhanced distribution capabilities and IT capabilities. These measures indicate the company’s commitment towards strong growth moving forward.

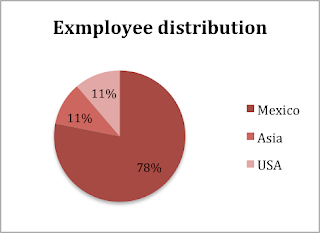

2. Strengthening USD v/s Mexican Peso

As the Mexican Peso gets weaker relative to the US Dollar it leads to a reduction in costs for MPAA, which has a majority of operations in Mexico. The company’s largest facility is located in Mexico and 78% of labour costs are incurred in Mexican peso. The company is also planning expansion projects in Mexico. Due to the weakening of the Mexican peso, the company can enjoy cheaper rent and labour costs. Furthermore, since MPAA sells its products only in North America, it is in no way adversely affected by the strength of the dollar.

Therefore MPAA benefits heavily from the increasing strength US dollar v/s Mexican Peso.

Source: FRED

Source: Annual Report

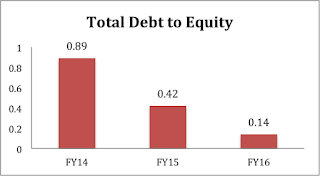

3. Declining debt to equity ratio

The company’s debt to equity ratio has been steadily declining and is also low compared to the industry average of 0.36.

Source: Annual Report

Lower debt reduces interest rate risk since the company’s debt carries interest at variable base rates, plus an applicable margin.

Risks/ Concerns:

· Volatility in commodity prices

MPAA is exposed to commodity prices such as copper and aluminium, which it uses as raw material.

· High P/E ratio of 47.87

P/E ratio is much higher than the industry average of 17.79. However, peer comparison is not very reliable since close competitors are private companies.

· Consumer concentration

Sales to three of the largest customers represent 87% of sales. Sales to AutoZone alone are 48% of sales

· High Competition

The industry is highly competitive and MPAA faces competition from local players such as BBB industries and Remy Inc, as well as from Chinese manufacturers.

However, it must be noted that the company is not exposed to the UK so it is unaffected by Brexit. It doesn’t have much exposure to China and due to its low debt, it is not affected by changes in interest rates.

Conclusion:

Due to strong industry trends, increasing market penetration and new product launches, the sentiment for MPAA is overall bullish. The company is currently trading at a discount and based on the forward P/E of 17x, and an EPS estimate of 2.24, the company should be trading between $36 and $39.

"this was vey ideal blog for automobiles. in the event that you need to understand more , check this site Latest vehicles and bikes

ReplyDelete"