Summary:

· Company shifting focus towards pharma segment, which has higher margins

· Specialty Pharma Business expected to grow rapidly and drive bottom line

· Expected deleveraging and FCF growth over the coming years

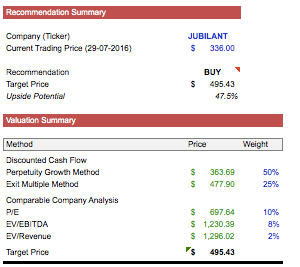

· Company trading at significant discount. According to valuation and analysis, there is ~45% upside

Company Overview:

Jubilant Life Sciences Limited is an integrated global Pharmaceutical and Life Sciences Company engaged in manufacture and supply of APIs, Solid Dosage Formulations, Specialty Pharmaceuticals and Life Science Ingredients. It also provides Services in Contract Manufacturing and Drug Discovery Solutions. The Company’s strength lies in its unique offerings of Pharmaceutical and Life Sciences products and services across the value chain. With 12 world-class manufacturing facilities in India, US and Canada and a team of about 6,100 multicultural people across the globe, the Company is committed to deliver value to its customers spread across over 100 countries. The Company is well recognized as a ‘Partner of Choice’ by leading pharmaceuticals and life sciences companies globally.

Product Overview:

The company widely operated in two segments: Pharmaceuticals and Life Sciences. In FY16, pharma contributed 52% to revenue and life sciences contributed 48%.

Global Presence:

The company’s market is primarily North America. 41% of its revenues come from North America. 65% of revenue in the Pharma segment comes from North America.

However, due to supply chain headwinds in the United States, the company currently plans to ramp up rest of the world business due to higher profitability there. Revenue’s from rest of the world are up 93% on a YOY basis. The company has solid partnership channels in Japan and Australia and is actively looking to expand product fillings in these markets.

The company currently has 10 vertically integrated manufacturing facilities, of which 7 are located in India and 3 are located in North America Therefore, the company incurs a portion of their costs in USD and a lot of their debt is also dollar denominated.

Due to this exposure to the USD and other currencies, the company faces exchange rate risk. However, since the company’s exposure to Europe is limited, the Brexit will not have a substantial effect on the company’s bottom line.

Management:

Brothers, Shyam Bhartia and Hari bhartia, are Chairmen and founders of Jubilant Bhartia Group.

Mr Shyam S Bhartia

Mr Shyam Bhartia is the chairman of Jubilant Life Sciences, Jubilant FoodWorks Limited and Jubilant Energy B.V. He is also Chairman and Managing Director of Jubilant Pharma Limited, Singapore.

Mr. Shaym Bhartia serves on the Board of several Public, Private and Foreign companies like Chambal Fertilizers and Chemicals Limited, India; BT Telecom India Pvt Limited; Putney Inc. USA; CFCL Technologies Limited (Cayman Islands), USA and Safe Food Corporation, USA etc. He was also a Director on the Board of Air India.

Mr. Hari S. Bhartia

Mr. Hari Bhartia is the Co-Chairman and Managing Director of Jubilant Life Sciences Limited, Co-Chairman of Jubilant FoodWorks Limited, and Chairman of Jubilant Industries Limited.

Mr. Hari is a member of India-USA CEO Forum and India-France CEO Forum. He is a regular participant at the World Economic Forum Annual Meeting in Davos and is a member of the World Economic Forum’s International Business Council and the Health Governors.

Mr. Shyam and Hari Bhartia have a lot of experience and have been felicitated with the ‘Entrepreneur of the Year Award’ at the prestigious AIMA Managing India Awards 2013, presented by the President of India. In 2010, the duo also shared the coveted Ernst & Young ‘Entrepreneur of the Year Award’ for Life Sciences & Consumer Products category.

The company recently completed management consolidation of Pharmaceuticals and Life Science Ingredients segments and appointed separate CEOs to focus on growth in the respective segments. This is pursuant to the consolidation of Pharmaceuticals and Life Science Ingredients under two independent segments to decouple the Pharmaceuticals segment from the Life Science Ingredients segment, thereby harnessing the true potential in each business to aid focused faster growth for the Company.

Mr. G.P. singh leads the Pharma business and Mr. Pramod Yadav and Rajesy Shrivastav lead the Life Science Ingredients Business.

Shareholding Pattern:

The promoters of the company hold a substantial portion of the company’s shares indicating strong insider faith.

Investment Trends:

Shift Towards the High Margin Pharma Segment

The company is gradually shifting focus from the LSI segment to the pharma segment as they see growth slowing down in life sciences and better margin opportunities in pharma.

Over the years, pharma segment’s contribution to EBITDA has been increasing and the trend is expected to continue. In a recent earnings call, Shyam S Bhartia, chairman and founder, remarked, “as you have seen, this year’s EBITDA is about 67% in the Pharma business and 33% is in LSI segment. I think this proportion will gradually move towards the Pharma business as we grow our Specialty business in US and other markets.”

Growth in the Specialty Pharma Business

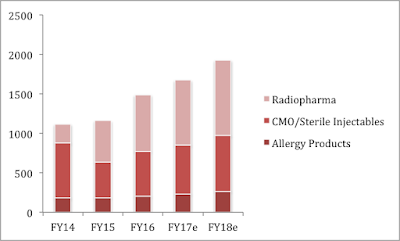

Specialty pharma business focuses mainly on sterile product offerings in radiopharma and contract manufacturing (CMO) and allergy therapy products. Specialty pharma currently forms 52% of sales in the pharma segment. The segment has been growing. Specialty Pharma business grew 26% year-on-year during FY-2016, with healthy growth in all key verticals.

The company has a clear differentiated strategy of niche products with limited competition, customer acquisition and focused product development in this business segment.

Radiopharma: Radiopharma is a niche segment with company’s products having therapeutic application in treatment of thyroid and cancer (I-131) and diagnostic application in brain imaging (gluceptate), thyroid scan( I-131), bone scan (MDP), etc. Radiopharma business has maintained a strong growth momentum in previous years and has grown 36% year-on-year in FY-’16 with 3-year CAGR of 51%.

With high natural entry barrier for new players and consolidation among existing competitors, Radiology business in US/Canada is to achieve 15% CAGR in sales.

MAA/DTPA (used for imaging of lung cancer) is the largest contributor and is likely to grow at 16% CAGR on limited competition between two generics and discontinuation of other generic. I131 (used for treating thyroid/kidney cancer) being second largest contributor in radiology is also benefitted from limited competition of generics and is expected to maintain 10% CAGR in FY16‐18E.

The company is also expecting to see growth due to product launches. This includes Ruby-fill, where the company has 505(b)(2) filing for diagnosis of coronary heart disease through PET procedures. FDA is actively reviewing the documents including clarification on labeling. The company expects to launch the product by Q4 FY-2017.

The market for Ruby-fill is currently ~ US$130m, serviced by only one player (Bracco), which is not able to service full demand & has an inferior profile to Jubilant’s product. Jubilant’s Ruby‐fill is expected to expand existing market of product to US$250m by 2020. Jubilant non‐AB rated generic is expected to receive better acceptance among specialists for cardiac therapy and may claim 50‐60% market share of existing sales of Ruby‐fill in FY18E and may gain potential revenues of US$100-120mn in FY19E

Contract Manufacturing (CMO)/ Sterile Injectables: CMO business grew 27% year-on-year in FY-’16. The company received a warning letter at it’s Spokane facility in Nov’13, which led to the drop in sales in this segment. However, after remediation efforts by the company, the warning letter was lifted on June’15. Sales in the segment have picked up since.

Though the company lost some customers during that time, according to company management, “the process of normalization of operations post resolution of US FDA warning letter is underway. This is backed by our healthy order book, which augurs well for this business. We believe that we are well positioned to capture business opportunities in this segment.” Studies have indicated there is an acute shortage of quality sterile facilities, and this demand-pull will lead to a growth in volumes in this business in 2017-18.

Allergy Therapy Products: Allergy Therapy products business grew 9% year-on-year in FY-’16 backed by rise in volume growth. Jubilant is one of the top three players in this extremely niche business in the US. This growth is expected to continue.

LSI Segment to Post Moderate Growth

During the last financial year, there was a fall in revenue in the LSI segment by 14% due to headwinds such as low commodity prices, tepid demand and low crude oil prices. Despite a fall in revenue, the company managed to grow LSI EBITDA by 39% YOY due to higher sales value added in Fine Ingredients products and various cost control initiatives and process efficiencies.

There has been a significant slowdown in the sale of pyridine since one of the end use of the Pyridine product, Paraquat, was banned in China. Paraquat forms almost about 70% to 80% of the Pyridine consumption. Therefore, sales of Pyridine have been affected in China, because sales of the end-use product have come down very significantly. Capacity utilization has thus fallen to 65% in FY16 from 90% in FY14

Thus, to deal with the situation, Jubilant has decided to add new products in their Pyridine facility, which are also derivatives of Pyridine. Two new products have been launched and a third product also will be starting by Q4 of this year. With these product launches, capacity will be utilized more optimally.

New Product launches

Along with the anticipated launch of Ruby-fill, the company is also planning to launch 7-8 products this year. The company has 72 filings with USFDA, of which 28 are pending and 8 have been approved last year. Of the 8 approvals last year the company has launched a few, but is expecting to get a full year effect this year. Other approved products are expected to be launched this year.

Deleveraging

The company generated substantial FCF last financial year and used it to pay off debt. According to management commentary, this trend is expected to continue, favorably affecting bottom line.

Due to these positive trends, EBITDA and Net Income are expected to grow.

Risks/Concerns:

1. Crude oil prices

2. Supply chain consolidation in the US

3. Currency risk

4. Delay in approvals

5. Regulatory Concerns

Looking at the chart above, one can see upward and downward surges in the value of the company's stock due to the Spokane facility shut down and reopening.

After historically underperforming the nifty index, Jubilant recently rose above and has been outperforming the nifty index since. It should be noted that in the previous years, Jubilant Life Sciences wasn't really a pharma company, it was predominantly a chemicals company with a small pharma segment and was therefore valued accordingly. With the recent expansion of the pharma business, the company's valuation is matching up to that of other pharma companies on the index and the company should reach that valuation within the next 2-3 years.

Recent selloff (with RSI dropping below 30) creates a good buying opportunity.

Recent selloff (with RSI dropping below 30) creates a good buying opportunity.

Future: