Share Price: 296.80

52 Week High: 368.95

52 Week Low: 219.95

I have spent the past several weeks asking people about their dairy preferences. "What is your preferred brand of milk?" "Do you prefer Gowardhan Ghee or Amul Ghee?" "Do you buy curd or make it at home?" After chatting with several people, at work, at casual parties, and at not so casual parties, I convinced people that I was a dairy salesman/mad woman. I came out of this convinced that people have started spending more on value-added dairy products. There is a shift in the Indian consumer, and as we continue to emulate the West, the demand for premium cheeses, flavored yogurt, whey protein like products is set to rise. Furthermore, the Indian housewife is extinct. The Indian woman will not be making ghee, or curd, or paneer at home, she will go to the store after a long day of work and buy them.

So, as an investor, I was inclined to bet on this trend of growing demand for dairy value-added products. I made a list of companies and tried to find the one which had a solid brand (in value added products specifically) and which was currently trading at cheap valuations. That is what every consumer looks for, and so should the investor.

Okay, so the first thing that jumps at you after looking at this graph is Kwality, right? You must be wondering, "what is up with Kwality? I love their ice cream." (yes, me too but that is owned by HUL now) As an investor, that looks like a great bet and it probably is. However, not right now. The company had some corporate governance issues recently and was put under ASM (Additional Surveillance Measures). Indian Markets are quite ruthless with that sort of stuff. A good time to look at Kwality would be after it comes out of ASM and when management clears the air. It could drop some more and stay there (for a long time). Check kwality share price if you are too tempted.

So yes, moving on to Parag. I ran the numbers first. It is currently trading at 30x trailing P/E while the median P/E in the Industry is 40x. Furthermore, this EPS is set to increase going forward, and hence it is trading at 25x FY19E and 20x FYE. The math here is quite simple, even if Parag continues to trade at a discount to peers, there is profit to be made. If there is multiple expansion, there is more profit to be made. If there is multiple expansion, and if eps rises more than expectations, there is even more profit to be made. Below are two sensitivity tables with different forward eps expectations (FY19 and FY20) and expected P/E multiples. The values in the table represent potential upside from CMP (current market price).

| 12 | 12.1 | 12.2 | 12.3 | 12.4 | 12.5 | |

| 10 | -60% | -59% | -59% | -59% | -58% | -58% |

| 20 | -19% | -18% | -18% | -17% | -16% | -16% |

| 30 | 21% | 22% | 23% | 24% | 25% | 26% |

| 40 | 62% | 63% | 64% | 66% | 67% | 68% |

| 50 | 102% | 104% | 106% | 107% | 109% | 111% |

| 60 | 143% | 145% | 147% | 149% | 151% | 153% |

| 13.5 | 14 | 14.5 | 15 | 15.5 | 16 | |

| 10 | -55% | -53% | -51% | -49% | -48% | -46% |

| 20 | -9% | -6% | -2% | 1% | 4% | 8% |

| 30 | 36% | 42% | 47% | 52% | 57% | 62% |

| 40 | 82% | 89% | 95% | 102% | 109% | 116% |

| 50 | 127% | 136% | 144% | 153% | 161% | 170% |

| 60 | 173% | 183% | 193% | 203% | 213% | 223% |

Yes, the math looks good, but there are two key assumptions at play here: increasing eps and P/E expansion. So let us take a deeper dive into both.

But before that, a little bit about the company: Parag Milk Foods (PMF), incorporated in 1992 with operations in just collection and distribution of milk, has now developed into a FMCG dairy company. It has diversified its product portfolio with 170 plus SKUs to cater to a wide range of customers via 6 brands—Gowardhan, Go, Pride Of Cows, ToppUp, Milkrich and Avvatar. The company has recently ventured into the whey consumer protein powder segment with Avvatar brand and fruit beverages category with Slurp brand. Parag Milk Foods (Parag) has made a leap in a short span by capturing leading market share in high-margin value-added products (VADP)—No. 2 in cheese (32% market share) and largest cow ghee brand in India. Parag boasts of strongest value-added portfolio contributing 64% to sales, way ahead industry’s 34%. This has resulted in it gaining leading market share in VADP (cheese, ghee) in record time. The company’s biggest competitive advantage is the scale created—invested INR3.5 bn over FY08-17 on high-margin cheese and whey.

Reasons for Growth:

1. Growing Industry

2. Continuing Product Innovation

PMF is the only dairy player that is integrated across the value chain from dairy farming to milk procurement, processing, distribution as well as branding. The company has historically been successful in introducing new products to tap new consumers. It has entered new segments with Avvatar (whey protein), GO protein powder, Slurp (milk based mango drink), premium ghee (Aurum), and Gowardhan Paneer with a 75-day shelf life. In the long term, this new product innovation strategy should provide it an edge over other dairy players. Apart from expanding its cheese portfolio, the company is also developing a premiumization strategy for its cheese products. This allows the company to grow topline and increase its margins, which leads to eps growth.

3. Growing of Health and Nutrition Segment

The company's strategy going forward is to scale up presence in health & nutrition segment through a widening product portfolio. As imports in the segment make up for ~50% of the industry, PMF sees a huge opportunity to drive growth. On the portfolio front, the company has seen healthy traction in the whey protein segment and plans to widen its product range in the sports nutrition segment under the Avvatar brand through the launch of variants (Muscle gainer, mass gainer, Runnners formula, etc). The product is India’s first Muscle Gainer to be certified by Informed Sports from a WADA approved lab in UK. PMF also recently entered the milk protein segment with the launch of Go Protein power (a 100% cow milk product with the highest protein content (~44%) among the products available in the segment). This is a INR14-16 bn category with other products like Proteinix with INR6bn sales and Ensure (Abbott’s brand) at INR3bn sales.

Furthermore, given the nature and limited distributors in the segment, PMF has set up a separate sales team for Avvatar portfolio. Moreover, to drive growth, the company has launched bonding programs with gym trainers who are key influencers in this segment.

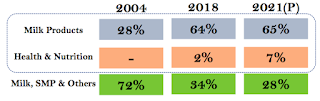

PMF is targeting ~7% market share in the segment over the next 2 years and expects to generate revenues of ~Rs1.2bn from the whey protein segment. The health & nutrition segment currently accounts for 2% of sales; which the company is targeting to increase to 7% by FY21E through the launch of new products and ramp up in reach.

As there is increasing awareness on health and nutrition, these segments are expected to keep growing. Furthermore, the company has an early mover advantage in the segment. A lot of the international products are difficult to find and do not have a good distribution network. If Parag is able to implement successfully, it will be able to rapidly gain market share (the cheese segment gained 33% market share in 5 years and became second in the segment after Amul). Furthermore, products like these are meant to cater to the upper middle class (which continues to keep growing) and the demand for these products also tends to be sticky and price inelastic. Once the company has developed its brand, it will be able to marginally increase the price of its products over time and continue top line growth.

4. Increasing Margins

5. Growth in Distribution

6. Growth in FCF

7. Change in Processes

Change in processes are likely to be driven by new management, and suggestions from Vector Consulting.

The company has recently made key changes to management as it has added several FMCG professionals to its leadership team. For the CFO position, Parag brought in Vimal Agarwal, from pepsico India (after 17 years there). Amarendra Sathe from Kimberly-Clark India, was brought in by the firm as CCO and Harshad Joshi, a dairy technologist with long stints at companies like Mother Dairy, joined as COO.

Furthermore, Parag has also hired an external agency, Vector Consulting, to drive improvements in its supply chain processes and enable higher sales with limited additional capex. Pilot project shows impressive results with average daily sales increasing by 53%, repeat orders increasing by 170%, number of unique SKUs increasing by 31% and number of outlets billed increasing by 200%

Reasons for Multiple Expansion:

1. FMCG Company

Parag has recently started rebrading itself as an FMCG company instead of a dairy company as it explands the value added products segment, enters other segments such as health and nutrition, and hires managers from FMCG.

Most FMCG companies trade at 40-60x earnings even with their earnings growing at low/mid single digits. With Parag showing a ~20% growth, if the market starts pricing Parag as an FMCG company, multiples are likely to expand.

(Parag is almost obsessed with rebranding itself as an FMCG company. Check out their most recent presentation.)

2. Market Leader

Parag is also a market leader in the value added products segment with its rapidly increasing market share. There is no reason for the company to trade at a discount. As the share price grows, it should start getting more attention from investors, and start trading at the median industry multiple.

1. Growing Industry

The Value Added Products segement is the fastest growing segment in the dairy industry. According to a crisil report, it has almost doubled in the past three years and this is likely to continue growing at 10.4% going forward due to increasing urbanization, rising income, vast vegetarian population and growing health consciousness.

Furthermore, according to Parag, traditional products industry (milk, ghee, paneer, butter) is growing at a 15% CAGR while the modern value-added products industry is growing at 26% (UTH milk, cheese, flavored milk, whey protein). Parag is well positioned to capture on these industry tailwinds with 64% of its revenue coming from value-added products.

PMF is the only dairy player that is integrated across the value chain from dairy farming to milk procurement, processing, distribution as well as branding. The company has historically been successful in introducing new products to tap new consumers. It has entered new segments with Avvatar (whey protein), GO protein powder, Slurp (milk based mango drink), premium ghee (Aurum), and Gowardhan Paneer with a 75-day shelf life. In the long term, this new product innovation strategy should provide it an edge over other dairy players. Apart from expanding its cheese portfolio, the company is also developing a premiumization strategy for its cheese products. This allows the company to grow topline and increase its margins, which leads to eps growth.

3. Growing of Health and Nutrition Segment

The company's strategy going forward is to scale up presence in health & nutrition segment through a widening product portfolio. As imports in the segment make up for ~50% of the industry, PMF sees a huge opportunity to drive growth. On the portfolio front, the company has seen healthy traction in the whey protein segment and plans to widen its product range in the sports nutrition segment under the Avvatar brand through the launch of variants (Muscle gainer, mass gainer, Runnners formula, etc). The product is India’s first Muscle Gainer to be certified by Informed Sports from a WADA approved lab in UK. PMF also recently entered the milk protein segment with the launch of Go Protein power (a 100% cow milk product with the highest protein content (~44%) among the products available in the segment). This is a INR14-16 bn category with other products like Proteinix with INR6bn sales and Ensure (Abbott’s brand) at INR3bn sales.

Furthermore, given the nature and limited distributors in the segment, PMF has set up a separate sales team for Avvatar portfolio. Moreover, to drive growth, the company has launched bonding programs with gym trainers who are key influencers in this segment.

PMF is targeting ~7% market share in the segment over the next 2 years and expects to generate revenues of ~Rs1.2bn from the whey protein segment. The health & nutrition segment currently accounts for 2% of sales; which the company is targeting to increase to 7% by FY21E through the launch of new products and ramp up in reach.

As there is increasing awareness on health and nutrition, these segments are expected to keep growing. Furthermore, the company has an early mover advantage in the segment. A lot of the international products are difficult to find and do not have a good distribution network. If Parag is able to implement successfully, it will be able to rapidly gain market share (the cheese segment gained 33% market share in 5 years and became second in the segment after Amul). Furthermore, products like these are meant to cater to the upper middle class (which continues to keep growing) and the demand for these products also tends to be sticky and price inelastic. Once the company has developed its brand, it will be able to marginally increase the price of its products over time and continue top line growth.

Management aims to increase EBITDA margin from ~10.5% currently to 11-12% by FY20E, supported by improved mix and cost efficiencies. The company intends to drive mix improvement through growth in value-added products and scaling up presence in the nutrition segment. On the cost efficiency front, PMF is focusing on 3 components - ensuring efficiency of trade promotions, curtailing inflation in non-milk cost of goods sold (COGS) through value engineering and operating efficiencies across the value chain.

5. Growth in Distribution

PMF derives a larger proportion (65%) of sales from West & South India, where company’s procurement and manufacturing is present, while the remaining (35%) comes from the North & East. The company recently acquired Danone’s facility in Sonipat, Haryana to scale up presence in the Northern & Eastern markets. Moreover, the company expects to achieve cost benefits through logistics and better inventory management, once the facility starts commercial production. Currently, PMF is focusing on a) setting up additional lines in the plant as well as testing existing lines in order to ensure the quality of output and b) setting up procurement and distribution network. The company has spent Rs. 140mn on the plant already and is expected to spend another Rs. 160mn to add new equipment to make pouch milk, butter milk, flavored milk, mishit doi and expand the yogurt capacity.

The company has also set up a team to build sourcing network from states like Madhya Pradesh, Rajasthan and Uttar Pradesh.

Distribution expansion remains a key focus area for the company. PMF is working on a two-pronged strategy, which involves expanding its product range/outlets as well as adding new outlets. The company plans to increase its retail footprint by 3-3.5x from 2.5 lakh outlets to 7.5 lakh outlets (targeting addition of 7,000-8,000 outlets/month). It also plans to increase its distributors chain by 2.5-3x from current 3000+ and super stockists by 1.5-2x from 140+.

The company has also set up a team to build sourcing network from states like Madhya Pradesh, Rajasthan and Uttar Pradesh.

Distribution expansion remains a key focus area for the company. PMF is working on a two-pronged strategy, which involves expanding its product range/outlets as well as adding new outlets. The company plans to increase its retail footprint by 3-3.5x from 2.5 lakh outlets to 7.5 lakh outlets (targeting addition of 7,000-8,000 outlets/month). It also plans to increase its distributors chain by 2.5-3x from current 3000+ and super stockists by 1.5-2x from 140+.

6. Growth in FCF

Management targets to reduce working capital from ~19.5% of sales currently to ~17-17.5% of sales in FY19. Management expects to improve working capital by reducing losses on expiry/aging products, better inventory management post recalibration of network and through SAP implementation. Further, PMF does not require any major capacity expansion over next 2-3 years and capEx requorement will largely pertain to maintenance capEx (2.5% of Sales) which will lead to an improvement in the return profile.

7. Change in Processes

Change in processes are likely to be driven by new management, and suggestions from Vector Consulting.

The company has recently made key changes to management as it has added several FMCG professionals to its leadership team. For the CFO position, Parag brought in Vimal Agarwal, from pepsico India (after 17 years there). Amarendra Sathe from Kimberly-Clark India, was brought in by the firm as CCO and Harshad Joshi, a dairy technologist with long stints at companies like Mother Dairy, joined as COO.

Furthermore, Parag has also hired an external agency, Vector Consulting, to drive improvements in its supply chain processes and enable higher sales with limited additional capex. Pilot project shows impressive results with average daily sales increasing by 53%, repeat orders increasing by 170%, number of unique SKUs increasing by 31% and number of outlets billed increasing by 200%

Reasons for Multiple Expansion:

1. FMCG Company

Parag has recently started rebrading itself as an FMCG company instead of a dairy company as it explands the value added products segment, enters other segments such as health and nutrition, and hires managers from FMCG.

Most FMCG companies trade at 40-60x earnings even with their earnings growing at low/mid single digits. With Parag showing a ~20% growth, if the market starts pricing Parag as an FMCG company, multiples are likely to expand.

(Parag is almost obsessed with rebranding itself as an FMCG company. Check out their most recent presentation.)

2. Market Leader

Parag is also a market leader in the value added products segment with its rapidly increasing market share. There is no reason for the company to trade at a discount. As the share price grows, it should start getting more attention from investors, and start trading at the median industry multiple.

Risks:

1. Volatility in Milk Prices

2. Competition1. Volatility in Milk Prices

Any material and sudden rise in milk prices may impact Parag’s margin if it is not able to absorb. Milk procurement prices jumped 27% in FY17. However, Parag was able to absorb due to premiumisation as demonstrated by 39bps rise in gross margin.

This is one of the biggest risks in all consumer-focused companies. The domestic dairy products industry is highly competitive with presence of large multinational companies as well as regional and local players. The company also competes with large dairy cooperatives; incentives offered by central or state governments to these could benefit such entities. Any steep increase in competitive pressure (such as mul getting aggressive in the value-added products segment) may impact Parag’s revenue growth prospects.

Conclusion:

Given these strong trends, and factoring in the risks, Parag is a good long term. I personally bought to stock at 281, and plan to hold it for the next 2-3 years.

Should you chose to buy the stock, I would recommend celebrating your purchase with some Gowardhan Mishti Doi. It is really quite delicious.

your blog has really amazing content thanks

ReplyDeleteMcx tips

nice

ReplyDeleteThanks for suggesting good list. I appreciate your work this is really helpful for everyone. Get more information at commodity trading tips. Keep posting such useful information.

ReplyDeleteWe specialize in market research reports, assuring flexibility, agility, and customized solutions for our clients. Through in-depth market insights and consultancy, we present our clients with the tools they need to be at the forefront of their industry – a position secured for far more than the near future.

ReplyDelete